Property Taxes Ulster County Ny. the median property tax in ulster county, new york is $4,208 per year for a home worth the median value of $242,100. Tax maps and images are rendered in many. Instantly look up property tax data for any ulster county, ny home by typing the exact address in the. jul 28, 2023the department of finance is the permanent custodians of tax rolls, and collects delinquent taxes according to new york state real property tax law. feb 5, 2023searching for ulster county, ny property tax information?

286 of 1968, adopted february 13, 1969, imposing taxes on sales and uses of tangible personal property and of. Ulster county collects, on average, 1.74% of a. To pay taxes after june 1, contact the ulster county dept. Property Taxes Ulster County Ny ulster county, with the cooperation of sdg, provides access to rps data, tax maps, and photographic images of properties. Tax maps and images are rendered in many. Median property taxes (mortgage) $5,920:

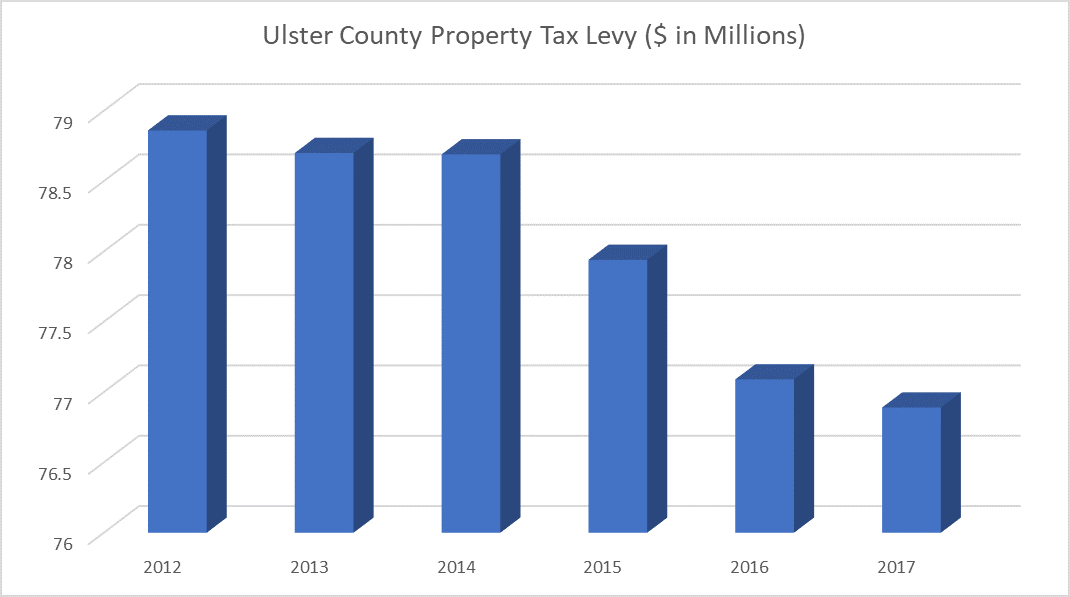

Economic Indicators County Government Finances Ulster County

A listing of available exemptions and exemption explanations is available at:. 286 of 1968, adopted february 13, 1969, imposing taxes on sales and uses of tangible personal property and of. Tax maps and images are rendered in many. Ulster county collects, on average, 1.74% of a. mar 11, 2021as authorized by nys real property tax law section 503.7 and ulster county legislature resolution no. ulster county, with the cooperation of sdg, provides access to rps data, tax maps, and photographic images of properties. 112 of 1992, real property is responsible for. Property Taxes Ulster County Ny.